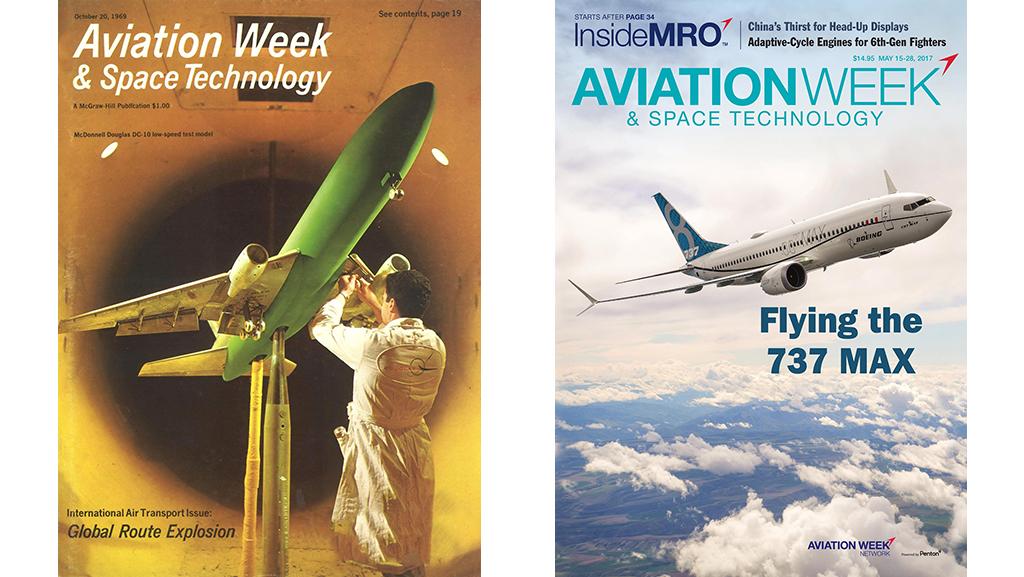

I get this Digital Magazine in my email box because I am an airline employee and it has a lot of good stuff in it. I thought it had some cool stuff about Boeing and the problems the company is having. I have blogged before about Boeing and the Hiccups the company is having. We in the aviation industry are concerned about the future of the company. We don't see Boeing going away, but somehow it going away from its Commercial airplane division and focusing on government contracts and leaving the commercial planes to Airbus and the Chinese startups which would be a disaster for America.

Douglas Aircraft started down a 30-year path toward extinction when it merged with McDonnell in 1967. McDonnell management prioritized military programs and was not willing to make the investment necessary to maintain its commercial jetliner market position. By the time it merged with Boeing, Douglas’ jetliner products were on their last legs.

It has been nearly 25 years since Boeing and McDonnell Douglas merged. Given Boeing’s significant engineering cuts, program execution problems, clear prioritization of shareholder returns, extremely uncertain product development road map and deteriorating market share outlook, it is time to consider whether Boeing Commercial Aircraft (BCA) is destined to share Douglas’ fate. Three criteria are key.

1. Slashed engineering spending. Boeing announced it would cut BCA independent (noncontract) research and development (IR&D) by about 25%, and indeed, 2020 spending fell from 2019 by slightly more than that.

Yet over the past 10 years (2011-20), BCA spent $22.3 billion on IR&D, an average of 4.8% of BCA revenue in that period. McDonnell Douglas, by contrast, spent an average of just over $300 million annually on all noncontract R&D between 1993 and 1996, and this included military and space technology research. If McDonnell IR&D was two-thirds commercial, then BCA’s engineering spending has been about 10 times greater.

However, much of this BCA R&D budget was spent on rectifying problems with the 787 and 737 MAX. The rest was spent on derivatives. Boeing has not launched a clean-sheet jetliner since 2004, when the 787 began. Douglas went 30 years without a new jet launch; Boeing is at the 17-year mark.

2. Market coverage gaps. Douglas never had the product line needed to cover all market segments. But as new segments emerged, such as twin-aisle twinjets, Douglas’ coverage further deteriorated. Also, it lost single-aisle bandwidth as the MD-90 failed as a broader family.

BCA has much broader coverage, with no significant gaps relative to Airbus. But its midmarket-segment standing is a major problem (see graph). The A321neo is outselling the 737 MAX 9/10 by about 5 to 1. This implies a sizable market-share loss in coming years.

3. Abandoned product developments. McDonnell Douglas mooted multiple concept airplanes aimed at shoring up its market standing: the MD-XX advanced trijet, the MD-XX twinjet and the MD-12 quadjet, among others. The MD-90 was envisaged as a broad family of single-aisle jets; ultimately, just the 150-seat -30 was built, with the -10, -40 and -50/55 failing to launch.

Boeing’s history of failed concept jets is smaller but more concerning. Over the past five years, considerable engineering resources were expended on the new midmarket airplane (NMA). As Senior Editor Guy Norris wrote recently (AW&ST Feb. 8-21, 2021, p. 12), the NMA might be revived. But as I wrote four years ago (AW&ST April 3-17, 2017, p. 12), using a twin-aisle to compete with a single-aisle may be a badly flawed idea, and the idea of leveraging an existing model series—a larger 737 MAX, shrunken 787 or reengined 767—is an even worse option. Boeing needs to go back to the drawing board and create a new large single-aisle.

These three criteria are cause for concern for BCA. Yet if Boeing does not launch a new product, industry competitive dynamics might still save BCA or at least prolong its decline. The slow death of Douglas Aircraft took 30 years. But Douglas faced two very aggressive competitors that were constantly investing in the future. If Airbus refrains from new clean-sheet launches and is content with a 60-65% market share, Boeing, even without a new airplane, might be able to maintain its current position for decades. This remains an industry with very high barriers to entry.

But if a new jetliner prime emerges, one more credible than the longtime Russian or Chinese contenders, BCA’s aging product line would be an easy target. Alternatively, Airbus could decide to make a few key investments in jetliner product development, targeting, say, the 737 MAX 8 with a stretched version of the A220 or targeting the 787 with a new clean-sheet model.

Boeing, therefore, should not rely on the complacency of competitors—that is a poor substitute for strategy or investing in the future. And a Douglas-like fate would be a tragedy for the entire industry.

The other consideration is that engineers are not in charge anymore and HQ is no longer at the Factory. It's bean counters. THAT is the death knell...

ReplyDeleteHey Old NFO;

DeleteThat is my worry, I understand the necessity of "Beancounters" they serve a purpose, a company that don't have fiscal discipline will be out of business, but being pennywise and pound foolish ain't the way to go.