I have been out of town visiting my mom up in Tennessee and was unable to post.

I saw the article and read it, and unfortunately, I tend to agree with it to an extent. I have been planning my retirement without Social Security in it despite my paying into it since the early 1980's. I believe that they will put a "means" test on it when it comes for me to retire since I have my own retirement, they will find a way to either cut my benefits or deny me completely because it wouldn't be fair for me to have extra money when others will not. The politicians have been kicking this can down the road since the 1970's and it took off especially in the 1990's with the proliferation of SSDI and "Crazy Checks". that were paid out if you could prove that your kid was "mentally challenged" and a lot of people saw this as an extra income stream and had their kids certified for the extra money. My attitude was and still is that if they had left it alone for the old people, the money would be fine, but they opened it up as a piggy bank for a bunch of other stuff and squandered it.

Younger generations in the U.S., including millennials and Gen Zers, are much more likely to believe that the Social Security system needs reforming than those in their 60s and 70s, according to a recent survey conducted by Redfield & Wilton Strategies on behalf of Newsweek.

The poll was conducted on December 8 among a sample population of 1,500 eligible voters in the U.S.

Some 40 percent of respondents said they believe that the Social Security program currently pays out more to retirees than it is receiving in Social Security tax payments, while 26 percent disagreed with this statement.

Millennials (those aged between 27 and 42), Gen Zers (those aged between 18 and 26), and Gen Xers (those aged between 43 and 58) were more likely than boomers (those older than 59 years old) to think that Social Security should be reformed.

According to the poll, 56 percent of Gen Zers, 76 percent of millennials and 69 percent of Gen Xers believed the system should be reformed, against 50 percent of boomers.

There were also overwhelmingly more millennials (52 percent) thinking that the system isn't getting as many tax payments as it was handing out benefits to retirees than any other generations, including Gen Z (39 percent), Gen X (25 percent) and boomers (39 percent).

"In general, millennials and plurals—our name for Gen Z—are skeptical that Social Security benefits as robust as those retirees like me currently enjoy will be available to them when they retire," Morley Winograd, author of three books on the millennial generation, told Newsweek.

"They have been told by Republicans in Congress, seconded by deficit hawks in think tanks, that the money will run out before they can claim it," he said. "None of that is true. But, luckily, the younger generation's skepticism of experts and politicians will help prevent the kind of unnecessary tinkering with future, never present, Social Security payments that some older folks advocate."

While boomers are the richest generations on the planet, millennials remain burdened by the debt "many of them incurred by paying excessive and economically unjustified tuition prices when we decided to make them the first generation in American history to have the majority of the burden of paying for higher education fall on them and their parents," Winograd said.

The older generation has on average a net worth 12 times higher than millennials, who are worth an average of $100,000.

What's the State of the Social Security Program?

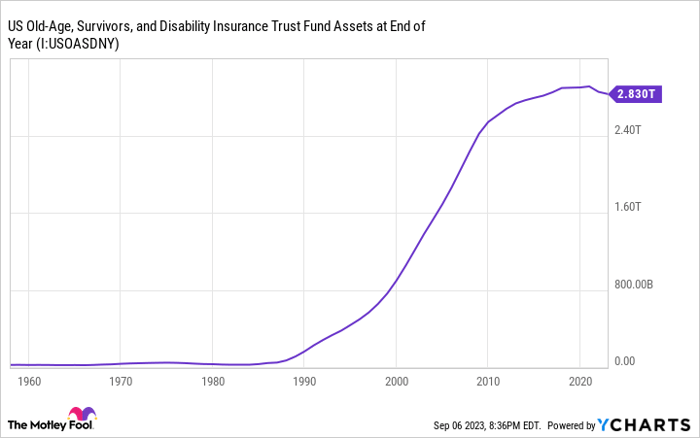

Social Security is currently facing an uncertain future as it is expected to face a 23 percent across-the-board benefit cut in 2033, according to the Committee for a Responsible Federal Budget, unless something changes until then. For an average newly retired couple, that means $17,400 less.

Fixing the Social Security system is becoming an increasingly urgent issue, according to Richard Johnson, director of the Program on Retirement Policy at the Urban Institute, a Washington-based think tank, told Newsweek.

"By law, Social Security payments cannot exceed the program's resources. The program now pays out more in benefits than it collects in revenue," the expert said.

While the Social Security's trust fund is currently making up the difference, this trust fund is widely expected to run out by 2034. "When that happens, Social Security will be able to pay less than 80 percent of promised benefits," Johnson said, citing the conclusion reached by several experts.

"Unless policymakers fix Social Security's finances in the next 10 years, millions of retirees and people with disabilities would plunge into poverty."

For Johnson, the solution might involve cutting benefits or increasing taxes—a change that would be unpopular among retirees, but necessary. "Fixing Social Security sooner rather than later would share the pain of any benefit cuts or tax increases among more people, reducing the pain for later generations," Johnson said.

Winograd is a little more positive on the outlook of the program, saying that a resilient U.S. economy could keep Social Security afloat.

"Whether or not Social Security is able to maintain its current levels of payments or not depends on what assumptions you make about the performance of the U.S. economy in the future—an impossible thing to predict with any degree of accuracy," Winograd said.

"But, for instance, if the economy were to grow at the 5.2 percent rate GDP grew in the third quarter of this year, there would be no problem with Social Security benefits in the foreseeable future," he said.

"Of course, this is a difficult rate to sustain, but with disruptors like AI now starting to change the productivity rates of the U.S. economy in ways as profound as the internet and personal computing did in the go-go 1990s, there is no reason to believe that the U.S. economy won't continue to outperform the expectations of most economists, who are still waiting to see if the recession they forecasted for last year and the year before arrives," he added.

"And, besides, if the system does turn out to need more money, it can be quickly and equitably raised by simply removing the income cap on paying Social Security taxes, which is one of the more egregious regressive elements of our current tax laws and very unpopular with young voters now flooding the electorate."

Money Talks News

Money Talks News